Dubai Real Estate Prices: An Overview of the Market

Dubai, known for its stunning architecture and luxurious lifestyle, has long been a sought-after destination for real estate investment. In recent years, the city’s real estate market has experienced significant fluctuations, making it an intriguing subject for investors, buyers, and analysts alike. This article aims to provide a comprehensive overview of the current state of Dubai’s real estate prices, examining key factors influencing the market.

Historical Trends:

To understand the current real estate prices in Dubai, it’s important to examine historical trends. Over the past decade, Dubai has witnessed remarkable growth and development in its real estate sector. However, the market experienced a correction in 2014-2016, leading to a period of stabilization and subsequent recovery. Since then, Dubai’s real estate prices have shown signs of growth, albeit at a more sustainable pace.

Factors Influencing Prices:

Several factors contribute to the fluctuation of real estate prices in Dubai.

Economic Factors: Dubai’s real estate market is highly correlated with the overall economic conditions. Factors such as GDP growth, employment rates, and government policies significantly impact property prices. A strong economy, coupled with favorable policies, tends to attract more investors and boosts property demand, leading to price appreciation.

Supply and Demand Dynamics: The balance between supply and demand is a crucial factor in determining real estate prices. In recent years, Dubai has witnessed a surge in new construction projects, increasing the supply of properties. However, demand has also remained robust, driven by a growing population, foreign investments, and a flourishing tourism sector.

Expo 2020 Effect: Dubai hosted the Expo 2020, a global event that showcased the city’s capabilities and attracted millions of visitors. The event’s positive impact on the real estate market is expected to continue even after its conclusion, as it has stimulated economic growth, created job opportunities, and heightened interest in Dubai’s property market.

Current Market Trends:

As of the latest available data, Dubai’s real estate market has demonstrated resilience and stability. Although the pace of price appreciation has moderated compared to previous years, property values have shown a gradual upward trajectory. This has been supported by sustained demand from both domestic and international investors, with certain areas witnessing higher growth rates.

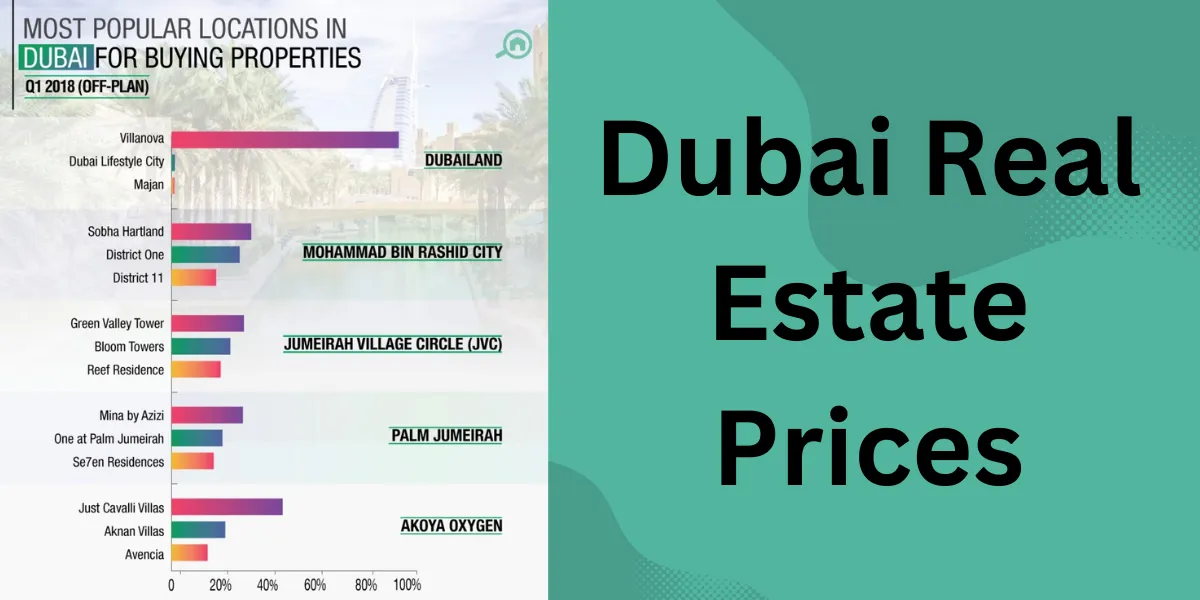

Popular Investment Areas:

Dubai offers a wide range of investment options for buyers looking to capitalize on the real estate market.

Downtown Dubai: Home to iconic landmarks such as Burj Khalifa and Dubai Mall, Downtown Dubai remains a highly desirable location for property investment. Its central location, luxurious amenities, and vibrant atmosphere contribute to its appeal.

Dubai Marina: Known for its waterfront living and stunning skyscrapers, Dubai Marina offers a mix of residential and commercial properties. The area’s popularity among expatriates and its vibrant lifestyle make it an attractive investment choice.

Palm Jumeirah: This man-made island, shaped like a palm tree, has become synonymous with luxury living. The Palm Jumeirah offers a wide range of high-end villas and apartments, attracting investors seeking exclusivity and waterfront views.

Dubai’s real estate market continues to evolve, reflecting the dynamic nature of the city itself. While historical trends, economic factors, supply and demand dynamics, and significant events such as Expo 2020 influence real estate prices, the market has shown resilience and stability in recent years. With a wide array of investment options available across various areas, Dubai remains an enticing destination for those seeking opportunities in the real estate sector. As always, it is crucial for buyers and investors to conduct thorough research and seek professional advice before making any investment decisions.